State deficit estimates often differ

The 2026 California state budget process lies ahead, beginning with the Governor's plans

Expect Different Deficit Estimates. I have no inside information on what the projected 2026 deficit will be in the Governor’s budget proposal later this week. Nevertheless, I counsel everyone to expect a different 2026 deficit estimate—perhaps significantly different—from the $18 billion figure cited in the Legislative Analyst’s Office (LAO) November outlook. Frequently, my experience has been that folks are puzzled when the annual LAO and administration deficit figures differ. In contrast, I advise everyone to expect big differences in these estimates, especially this year.

Near-Term Revenue Results Could Be a Lot Higher. In its November outlook, the LAO estimated that California’s General Fund tax revenues would be $11.1 billion higher than the June 2025 budget projected across the three fiscal years 2024-25, 2025-26, and 2026-27 (the three years known as the “budget window,” which are the three fiscal years directly at issue in the 2026 state budget process). Yet, as of the end of November, 2024-25 and 2025-26 General Fund receipts already had exceeded the June budget forecast for that period by more than $9 billion, with 19 months remaining in that budget window. Accordingly, if receipts continue to flow in as they have been—fueled by the boom of the so-called “artificial intelligence” sector cited by LAO—the possibility exists that budget window revenues could eventually come in at $20 billion or even $30 billion above the June 2025 budget projections—far stronger than projected by the LAO.

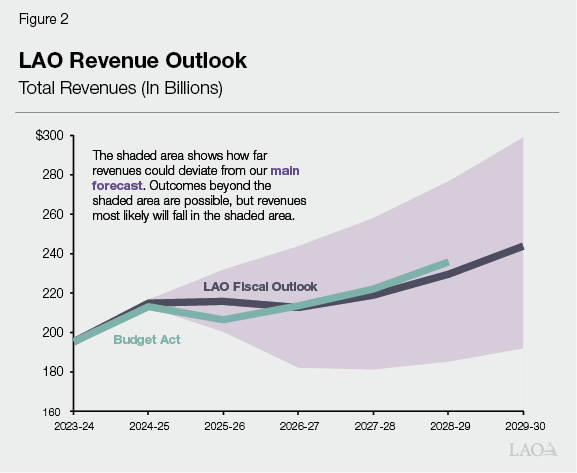

Such an outcome seemingly would be well within the “cone of uncertainty” the LAO itself included with its November revenue forecast, as shown below (illustrated by the “shaded area” of this LAO graphic).

Other Near-Term Projections Also Could Differ Significantly. The LAO, in its November outlook, projected that the $11.1 billion of budget window revenue gains would be nearly entirely offset by $7.0 billion more in required state spending for schools and community colleges (Proposition 98 spending) and $3.4 billion more in required transfers to state budget reserves and related accounts (Proposition 2 deposits). Added revenue gains above the LAO’s estimates likely would be offset by higher Proposition 98 spending, but perhaps at a smaller percentage than Proposition 98 offset the first $11 billion of revenue gains cited by the LAO. The administration’s Proposition 2 and other reserve estimates also may differ significantly. In short, higher revenues could help reduce the deficit to be corrected in the 2026 budget process by billions.

The LAO also projected that non-Proposition 98 spending during the budget window would be $5.7 billion, net, higher than the June 2025 forecast, but the administration’s estimates easily could be a few billion dollars higher or lower, especially for health and social services costs related to the federal Republicans’ H.R. 1 legislation and state administrative costs for civil service pay, benefits, and other state department expenses.

Budget Process Considers Rationale for Administration Estimates. The LAO—and the Legislature generally, of which LAO is a part—has a much smaller budget staff than the administration’s budget apparatus, which encompasses staff in the Department of Finance and dozens of other state agencies and departments. In general, the administration has better access to information about state program costs and a far bigger staff to make estimates about both current-law state costs and new proposals. Nevertheless, via the annual budget process, legislative and LAO staff must advise elected legislators in reviewing the administration’s budget estimates. Between now and May, the legislative budget subcommittee process can be expected to validate the suitability of most administration estimates, while casting doubt on other estimates. This is a normal part of the process. Health, social services, and corrections costs are among those where the legislative budget process can point the way to significantly higher or lower estimates for use in the June 2026 final state budget. In short, expect key spending estimates to change between now and the conclusion of the budget process in May and June.

Could Revenue Growth Slow Down? Of course, revenue growth could slow down. This could happen if stock prices dip significantly, if the state’s key technology industries see a big drop in valuations and investment activity, if the federal government’s erratic tariff raising hurts the economy more, or if some of California’s wealthiest taxpayers take new actions—in addition to prior, longstanding actions—to avoid paying some California taxes in the future. These issues could limit the revenue upside identified above for the 2026 budget process or, perhaps more worryingly, reduce future years’ revenues below LAO estimates. As the LAO identified $35 billion annual budget deficits for 2027-28, 2028-29, and 2029-30, negative effects on future deficits due to a “bursting of the AI bubble” or other issues could be deeply problematic for California’s public programs, including public schools.

The 2026 Budget Process Lies Ahead. Following the Governor’s release of his January budget plan, both houses’ budget subcommittees will begin considering the Governor’s proposals. In the end, the June 2026 budget will balance the 2026-27 state budget as the California Constitution requires, likely based largely on the administration’s May revenue estimates and a mix of spending estimates and proposals from the Governor and the Legislature. The coming months of subcommittee activity likely will focus less on the changing deficit number for 2026 and more on two key issues: (a) which Governor’s proposals for closing the 2026 deficit are the most problematic and (b) how much should the state aim to reduce future years’ projected deficits. Those discussions can lead to new proposals and alternatives from both the executive and legislative branches as the next six months proceed.

The Governor’s budget proposal can be expected later this week, with details to be released via dof.ca.gov. It typically takes a few weeks for legislative staff and others to parse the proposal’s details. Trailer bill language is due from the administration by February 1, pursuant to state law.