Proposition 30 taxes expire in 2030

Currently results in more than $10 billion of state tax revenue per year

One of California’s voter-approved marginal tax rates for higher-income personal income tax (PIT) filers expires at the end of 2030. Absent legislative or voter action to extend these taxes, the state budget then will lose perhaps more than $10 billion of annual tax revenue. Compared to budgets under current tax law, deficits would increase by several billion dollars per year, and guaranteed school funding would decline by several billion dollars. From a perspective of prudent planning for tax and fiscal policy, a decision to extend the current taxes, modify them, or let them expire ideally would be made a few years prior to 2030.

Because the state’s multiyear budget forecasts only go out about four years, the deficit pressures from expiration of these voter-approved temporary taxes are not yet shown in those forecasts. Similarly, the forecasts do not account fully for deficit pressures from the 2030 end of the existing cap-and-trade authorization or the long-term decline of the state’s fuel taxes.

Proposition 30 Approved in 2012. Proposition 30 was one of the key measures that boosted California state finances out of their Great Recession mess. Approved by 55% of voters at the November 2012 election, this initiative amended the State Constitution to temporarily increase the state sales tax for all taxpayers and personal income (PIT) tax rates for single filers with over $250,000 of income and joint filers with over $500,000 of income.

Proposition 55 Approved in 2016. In November 2016, a new initiative, Proposition 55, amended the State Constitution again to extend Proposition 30’s PIT rate increases for upper-income taxpayers to 2030. (Proposition 55 did not extend Proposition 30’s sales tax rate increase, which expired at the end of 2016.) Proposition 55 passed with approval by 63% of voters.

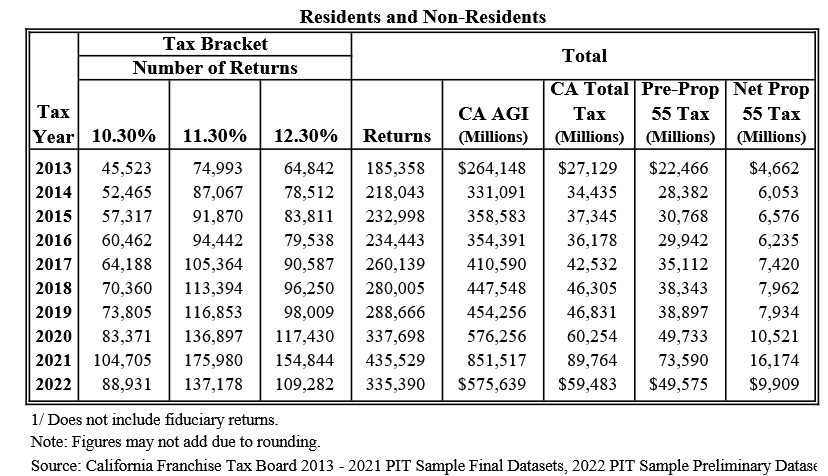

More Than 300,000 Tax Returns Affected. Because tax tables generally are indexed annually for inflation, the Proposition 30/55 PIT rates now apply to single filers making over $360,659 per year, to joint filers making over $721,318 per year, and head-of-household filers making over $490,493 per year. These taxes now typically apply to between 300,000 and 400,000 of California’s 19 million annual PIT returns.

Growth of Proposition 30/55 Revenues. Proposition 30 income tax revenues, as extended by Proposition 55, have grown to more than $10 billion per year. While technically deposited into the Education Protection Account created by the measure, these revenues are treated as General Fund taxes in budgeting and count in calculations of Proposition 2, 98, and other requirements.

The Franchise Tax Board estimates that “net Proposition 55 tax” revenues have grown as shown in the table below (excluding fiduciary returns): from $4.7 billion for tax year 2013 to $16.2 billion in 2021 and $9.9 billion in 2022. According to recent administration estimates, these revenues were around $9 billion for tax year 2023 and will be about $10 billion for 2024 and $11 billion for 2025. Given that they are paid by high-income filers, with varying annual returns from stock, option, bonus, and business income, these revenues are somewhat volatile.

Extending or Modifying the Taxes. While Proposition 30 and Proposition 55 were initiative constitutional amendments—meaning they were placed on the ballot by the gathering of voter signatures—these taxes could be extended by initiative constitutional amendment or, in some form, by initiative statute, or they could be extended in some form by legislative statutory action (with a two-thirds vote in both the Senate and the Assembly). Such extension measures could modify the taxes, if desired.

Proposition 63 Taxes Are Separate. Separate from Proposition 30/55 taxes, Proposition 63 (the Mental Health Services Act)—approved by voters in 2004—imposes a permanent 1% tax on filers with taxable incomes over $1 million. Proposition 1, approved by voters in June 2024, did not change the Proposition 63 tax, but did change how its funds were used, shifting some funds from counties to the state.