Projected revenues did not materialize in November

LAO lowers its state revenue outlook considerably in new report

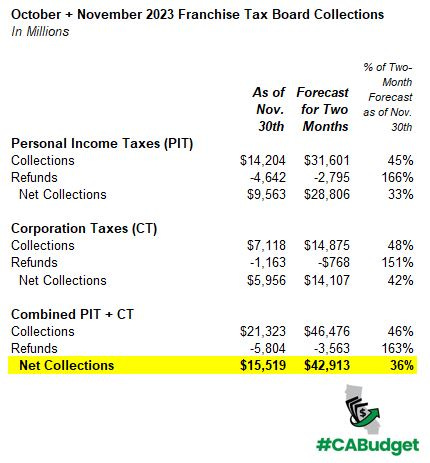

High-Income and Corporate Payments Much Less Than Projected. California’s 2023 budget anticipated that $42 billion of personal and corporate income tax payments would be delayed from earlier in the year to October due to the IRS’s ten-month deadline delay for certain filers’ 2022 and 2023 tax obligations (eventually extended to November).

Perhaps around $15 billion of that was paid by high-income and big corporate filers in October, but very little came to state coffers in November. Accordingly, collections by the Franchise Tax Board for the two months of October and November combined, net of refunds, were about $27 billion short of budget estimates. These shortfalls seemingly will be spread across three fiscal years (2021-22, 2022-23, and 2023-24) in the state’s budgetary accounting system. The 2023 state budget reflected some lower revenue estimates. The last few weeks’ shortfall signifies that 2022 and perhaps 2023 tax liabilities were several percentage points short of those 2023 budget estimates.

(The figures above are my rough count. Reconciled figures will emerge from state tax agencies in the coming weeks. The figures above do not include personal income tax withholding collected by the Employment Development Department or sales taxes.)

New LAO Estimates. In advance of its upcoming Fiscal Outlook, the Legislative Analyst’s Office (LAO) has released a significant downward revision of its state revenue estimates here. Note that this is just a revenue estimate from the LAO. The size of the LAO’s projected 2024 budget problem—pegged at about $15 billion by the administration at the time the 2023 budget was passed—likely will grow by a smaller amount than the office’s $58 billion lowering of revenue estimates. That is because lower revenues result in what some describe as “automatic balancers” in California’s Constitution—in particular, lower minimum guaranteed funding for public schools and lower required rainy-day fund deposits, retroactive, in some cases, to the 2022-23 fiscal year. Moreover, the administration will release its own independent revenue and spending estimates in January with the release of the Governor’s 2023-24 budget proposal.

The LAO’s new revenue forecast suggests a 2024 budget problem maybe in the $40+ billion range (my very rough math). The LAO Fiscal Outlook, expected soon, will give its estimate of the 2024 budget problem (the amount of budget-balancing actions needed to pass the June 2024 state budget).

My Take. California will face a significant budget challenge in 2024, requiring cuts or delays to planned one-time spending and other actions. Actions to prioritize classroom funding and other core programs remain important even in such a budget environment. Tens of billions of dollars of reserves remain available and, for now at least, buttress state programs against cash flow pressures.

Forecasting California tax revenues is always difficult. Current challenges in that regard include not only the usual uncertainty about the direction of the stock market and high-income filers’ capital gains and options, but also the unprecedented nature of the post-COVID recovery and the massive lags in tax data resulting from the IRS’s ten-month delay of 2022 and 2023 tax payments by many of the state’s wealthiest. After all, only now are we starting to get good data on 2022 tax liabilities of the state’s high-income filers—just as 2024 is set to begin.

I am, for the moment, somewhat more optimistic than the LAO about state revenues and the California economy. Stock prices are now about 8 percent above the 2023 budget’s expectations, and California is well positioned for continuing economic growth with artificial intelligence technologies and federal defense investments. California’s tourism economy also should benefit from continued recovery of international visitation. The number of California payroll jobs continues to rise, and California’s October 2023 job gain made up 27% of the nationwide growth reported for that month. Nationally, GDP growth has been robust and recently was revised upward for the third quarter despite persistent fears of recession just around the corner.

Both the LAO and the Department of Finance will monitor developments in tax collections, data on past tax receipts, and economic trends through May—five months from now—when updated estimates are released weeks prior to passage of the 2024-25 state budget.