November tax receipts now key for fiscal trend

October FTB collections far below projections as many high-income filers wait to pay

Revenue Trend Should Be Clearer After Thanksgiving. Due to the unexpected, last-minute IRS added deadline extension to November 16 for most Californians, many high-income and some corporate taxpayers have extended their nine-month hiatus on filing and paying income taxes to a tenth month. Accordingly, the revenue trend should be clearer—likely billions higher or billions lower than 2023 state budget projections—soon after Thanksgiving. This assumes that the IRS and the state Franchise Tax Board (FTB) do not extend California filers’ payment hiatus yet again before November 16.

IRS Added Delay May Limit Information for Budget Planning. As noted last week, the one-month added delay may limit the tax revenue information available for development of the Governor’s Budget forecast, which is due to be released on or before January 10. Keep in mind: the state is still waiting for 2022 tax returns for many of its highest-income taxpayers. Administration and LAO forecasters, as always, will take their best shot with the revenue and economic data available. The state’s formidable cash position limits, for now, the need for immediate budget corrections due to the unprecedented delay of major tax payments.

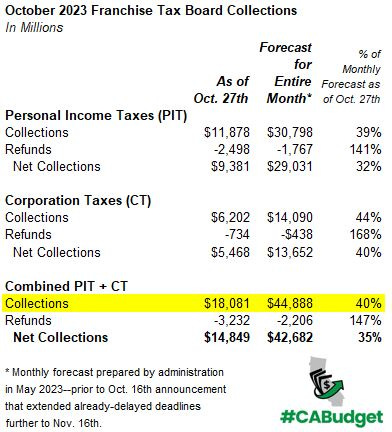

FTB Collection and Refund Data for October. The table below summarizes FTB collections for this month through Friday, October 27, and how far they have been below earlier projections. In addition to lower-than-projected collections, refund volume has been elevated. On net, taking into account both collections and refunds, FTB receipts are about $28 billion below the projection for the entire month so far. (This does not account for other receipts not affected that much by the IRS delays, such as personal income tax withholding collected by the Employment Development Department and sales taxes.) Only time will tell whether this $28 billion shows up in whole or in large part over the next month, in conjunction with the IRS’s new November 16 deadline.