April 15 is Tax Day. For almost all Californians, today is scheduled to be the final day to file 2023 personal income tax (PIT) returns, make payments for 2023 income taxes in anticipation of submitting extension returns on October 15, and make estimated tax payments for the first quarter of 2024. For the entire month of April 2024, the Governor’s January budget forecast anticipates receipt of $16.9 billion of PIT collections and $4.7 billion of corporate income tax collections, net of refunds.

$9.2 Billion of Net PIT Collections Projected at FTB for the Month of April. Daily collection activity related to returns, however, is focused at the Franchise Tax Board (FTB). The January budget forecast anticipates $7.7 billion of PIT withholding this month, generally collected by the Employment Development Department (EDD), such that the net amount of PIT projected to be collected at FTB is about $9.2 billion (that is, the $16.9 billion amount in the prior paragraph less the $7.7 billion anticipated in PIT withholding at EDD). $9.2 billion is the amount we hope to see in net PIT collections at FTB by the end of April in order to hit the revenue forecast for this month.

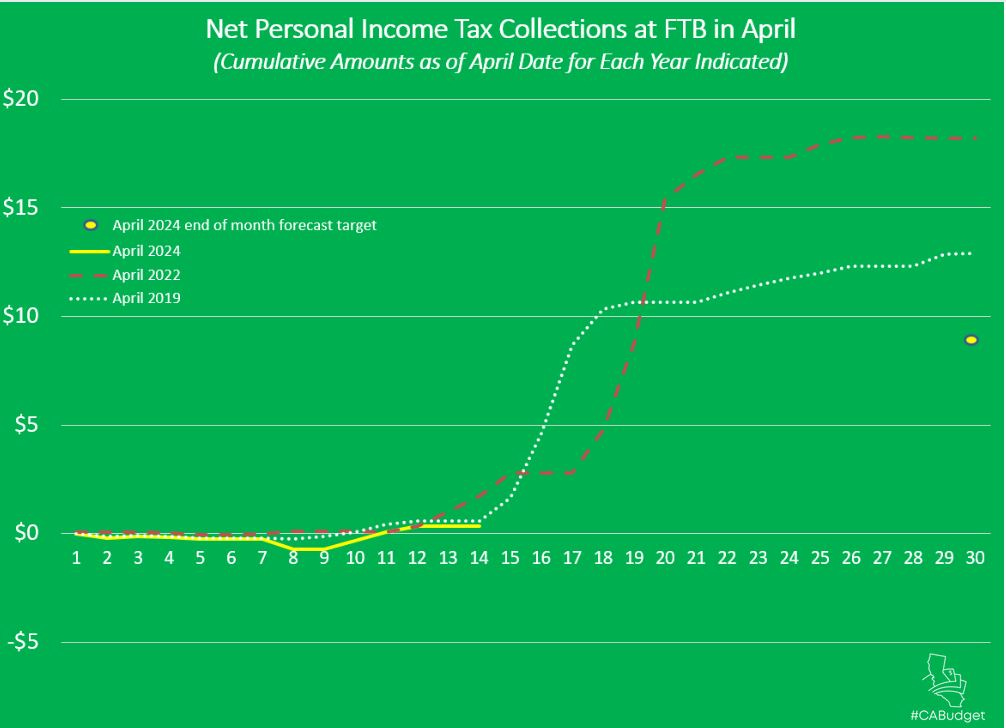

Tracking April FTB Tax Collections. To track April income tax collections, state forecasters look at daily collection and refunds trends in prior years as a basis of comparison. With COVID- and storm-related tax filing extensions, however, most recent years have seen atypical April collection patterns at FTB. The chart below shows the cumulative net PIT collections at FTB as of each day in April for 2024 (so far, in yellow), April 2022 (in white dots), and April 2019 (in red dashes), the latter of which were relatively normal collection months. The yellow dot above April 30 represents the $9.2 billion forecast for the end of this month, April 2024. That $9.2 billion forecast is substantially less than collected in either April 2019 or April 2022, reflecting previously recorded weakness in 2023 tax collections by high-income Californians due to stock market drops in the summer and fall of 2023 as well as challenges that year in the technology industry (including the initial public offering market).

FTB Collections Typically Peak in the Few Days After Tax Day. As the graphic shows, net collections at FTB typically are focused over the few days after the annual tax payment deadline. For most people, that deadline is today, and it was on April 18 in 2022 and April 15 in 2019. Accordingly, a big tax collection week is expected in the coming days.

Daily Tax Tracking Information Online. I will track daily FTB PIT receipts via my accounts on Threads or LinkedIn. A post summarizing the monthly trend will be sent out to this Substack list closer to the end of the month, barring any major unexpected developments in the meantime.