Legislative budget action this week

Floor action expected Thursday, June 13 following committee hearings

Three budget-related bills were posted online over the weekend in anticipation of legislative floor votes on or before June 15. The Assembly Budget Committee heard the recently amended Proposition 98 suspension bill and taxation trailer bill on Tuesday, June 11, as archived here. Assembly analyses of those two bills are here. The Senate Budget and Fiscal Review Committee is scheduled to hear the bills at its Wednesday, June 12 hearing, the analysis packet for which is here. Floor action is likely in both houses of the Legislature on Thursday, June 13.

The Assembly Budget Committee has released its annual Floor Report on the legislative budget bill here. The Floor Report includes information on the legislative budget plan, updated from the earlier May 30 committee report.

The introduction to the Assembly Budget Committee floor report follows at the end of this post.

Assembly Floor Report Introduction (6/11/2024)

In June 1969, 55 years ago this month, many California legislators disagreed strongly with Governor Reagan about the state budget. Assembly Democrats wanted more funding for schools. The resulting dispute, then “one of the bitterest and longest fiscal deadlocks in history” (The Sacramento Bee, 7/3/1969), led to Assembly Constitutional Amendment 9, authored by Assembly Ways and Means Committee Vice Chair Robert Crown (D-Oakland). Voters approved ACA 9 as Proposition 3 at the November 1970 general election.

The June 15 Deadline: Promoting Legislative Budget Priorities. Proposition 3 introduced the June 15 deadline for a legislative budget bill and the January 10 deadline for governors to make their annual budget proposals. This constitutional amendment allowed legislators to stand up for their principles in the annual budget process. It increased the time they had to review Governor’s budget proposals and required passage of a budget bill advancing legislators’ priorities about two weeks before the July 1 start of the state fiscal year. Consistent with Proposition 3, as amended, legislators now must pass a budget bill promoting their priorities on or before Saturday, June 15, 2024. AB/SB 107 (essentially identical versions in both houses) is proposed as the legislative budget bill for 2024. It reflects the joint legislative budget plan approved by Assembly and Senate budget committees on May 30, 2024.

Upcoming Budget Legislation. Budget negotiations between the Governor and legislative leaders are underway. The proposed legislative budget bill, AB/SB 107, may be amended later via a “budget bill junior” to reflect subsequent budget compromises between the Legislature and the Governor. In addition to two budget-related bills that went into print on June 8--AB/SB 154 and AB/SB 167—other bills related to the budget (“trailer bills”, authorized by Section 12 of Article IV of the Constitution) will be introduced in the coming weeks with statutory changes needed to implement the budget plan. Most of the content of the trailer bills has been posted online in some form at the Department of Finance website for the past several weeks or months, and budget proposals have been discussed in dozens of budget subcommittee hearings.

----

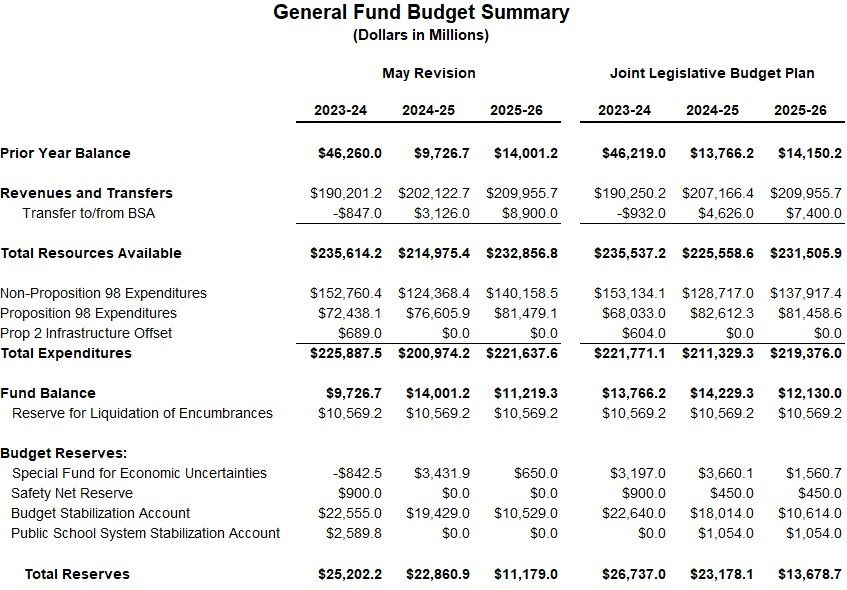

General Fund Spending Down Sharply from Previous Years’ Expectations. According to administration estimates—updated to reflect the recently proposed suspension of Proposition 98 in 2023-24—the legislative budget plan, including AB/SB 107, would result in spending from the General Fund totaling $196 billion in 2022-23, $222 billion in 2023-24, and $211 billion in 2024-25. This is about $11 billion less over that three-year period than the Governor proposed on January 10, 2024. Furthermore, illustrating how the post-COVID tax revenue slowdown has affected state finances, note that the June 2022 budget act anticipated the General Fund spending $78 billion more than the current legislative budget plan projects over the same three-year period.

Budget Plan Also Includes Federal, Bond, and Special Fund Expenditures. Special fund and bond fund spending in the legislative budget plan has been estimated at $78 billion in 2022-23, $109 billion in 2023-24, and $83 billion in 2024-25. (Estimated special fund spending in 2023-24 includes proposed use of most of the Proposition 98 reserve fund to support public schools and higher special fund outlays for climate, transportation, and health programs.) Federal funds passing through the state treasury—largely for health and human services programs—are estimated at $141 billion in 2022-23, $159 billion in 2023-24, and $153 billion in 2024-25. November 2024 bond proposals currently are pending before the Legislature and, therefore, are not reflected in the budget plan. If voters approve new bonds, future budgets would reflect added bond fund spending and debt service costs.

Legislative Budget Aligns With Governor’s Plan, With Key Modifications. The legislative budget plan, like the early action budget plan in April, aligns with the bulk of the Governor’s budget proposals. The joint legislative budget plan starts a three-year suspension of corporate net operating loss (NOL) deductions and various business tax credits in 2024—one year earlier than the Governor proposed. This results in the legislative plan including over $5 billion more General Fund revenues in 2024-25 than the Governor’s plan. These higher revenues allow more school spending across the 2023-24/2024-25 period, as well as restoration of some social services, health, and housing program reductions proposed by the Governor. Coupled with larger reductions in spending of some programs (most notably, prison spending), the legislative plan’s higher revenues allows maintenance of somewhat bigger reserves than those in the Governor’s plan through 2025-26. In climate and natural resources programs, the legislative plan shifts funding to better reflect legislators’ priorities.

Balances 2024-25 and 2025-26 Budgets…Projected Deficits in Later Years. Notably, unlike most prior California state budgets that address deficits, the legislative budget plan—like the Governor’s May Revision—balances not only this year’s budget, but also next year’s, based on the administration’s state revenue estimates. The legislative plan’s spending restorations and the one-year earlier end of the NOL/tax credit suspension would result in somewhat higher annual deficits than the $11 billion to $14 billion operating shortfalls for 2026-27 and 2027-28 estimated in the Governor’s May Revision. Furthermore, AB/SB 167 notes the intent of the Legislature to provide greater assurances that companies unable to use tax credits during the three-year suspension period will be able to benefit from foregone credits in later years via a refundability option. That future legislation will affect future deficit estimates, as will any changes in revenue projections. May 2024 state income tax revenues—based on preliminary figures received in recent days—were more than $2 billion above the May Revision projections. (The figure below reflects the plan’s scoring, including the effects of added NOL/tax credit suspension revenues added to 2024-25 and the Proposition 98 suspension in AB/SB 154.)

Based on preliminary scoring shared with the budget committees on May 29, reductions accounted for $17 billion of $47 billion of 2024-25 balancing solutions, while revenues accounted for $11 billion, fund shifts $7 billion, delays $6 billion, reserves $5 billion, and deferrals $2 billion.

Reflects Modified Version of Recent Proposition 98 Suspension Proposal. The legislative budget plan includes a modified version of the amended Proposition 98 school funding proposal announced by the Governor on May 28. Given the recent ups and downs of state revenues and spending, the state budget cannot currently cover all Proposition 98 obligations over the two-year period beginning in 2022-23. The legislative plan reflects a version of the Governor’s May 28 proposal—itself, a modified version of a January Governor’s proposal—to accrue $6.2 billion of funds previously appropriated to school districts for 2022-23 over several years beginning in 2026-27—that is, those funds will be accounted for in the General Fund over several future years, instead of in 2022-23.

In addition, AB/SB 154 would suspend Proposition 98 in 2023-24 at a reduced level, with state and local Proposition 98 funds at $98.5 billion ($3 billion below the level in the May Revision). With the suspension, over $8 billion of “maintenance factor” is created—a constitutional requirement to return school and community college spending to levels they would have reached without the suspension in the coming years. In effect, schools and community colleges will get a higher percentage of future revenue growth than normal until the maintenance factor is paid and built back into the Proposition 98 base. Use of $8 billion from the Proposition 98 reserve—created with passage of Proposition 2 (ACAX2 1) of 2014—helps protect classroom funding despite the proposed suspension.

In the legislative budget plan, with more revenues, school funding also is higher in 2024-25 with Proposition 98, consisting of General Fund and local property taxes, funded at the minimum guarantee level of $115 billion ($6 billion more than in the May Revision). Over $4 billion of the maintenance factor would be paid and built back into the Proposition 98 base in 2024-25, according to current estimates. Consistent with the Governor’s amended Proposition 98 school funding proposal, the legislative plan uses Legislative Analyst’s Office property tax estimates.

Responsible Budgeting Reforms. The legislative budget plan embraces important responsible budgeting reforms that will strengthen the state’s budget resilience in the future and help further avoid significant budget shortfalls. Details of the following proposals are still under discussion between the two houses and the administration.

Updating the state’s rainy day fund (the Budget Stabilization Account):

Increase the size of the rainy day fund from 10 percent of the state budget to 20 percent.

Exclude deposits into the rainy day fund from the state appropriations limit (Gann Limit) so that the budget is not forced to allocate funds and can instead responsibly deposit funds into budget reserves to protect against future downturns.

The Assembly also has advanced the idea—originally included in bipartisan ACA 11 (as amended February 20, 2020), but stalled due to the pandemic—of expanding the Legislative Analyst’s Office (LAO) as part of the reserve ballot measure in order to enhance independent analysis, oversight, and transparency of public finances. An expanded LAO could help policy makers provide needed oversight of the budget reserves, the state’s fiscal health, and the effectiveness of state spending.

Creating a new “Projected Surplus Temporary Holding Account”:

This new fund will help avoid the problems the state has experienced since 2022. In that year, there was a significant surplus projected, and the budget allocated that surplus pursuant to constitutional requirements.

It turned out that the surplus was not a large as projected, but the budget had already allocated the surplus at the higher level.

Under this reform, a portion of any projected surplus will be deposited into Projected Surplus Temporary Holding Account where they will be held until a future year once it is clear whether the projected surplus of revenues actually materialized.

Proposition 98 Funding: Early Education, TK-12, and Community Colleges

Provides a total Proposition 98 General Fund funding level of $97.5 billion in 2022-23, $98.5 billion in 2023-24, and $115.267 billion in the Budget Year.

Suspends the Proposition 98 guarantee in the current 2023-24 Budget Year, pursuant to the constitution, to $98.5 billion, creating an estimated $8.314 billion in maintenance factor.

Provides a total of $115.267 billion for Proposition 98 funding for 2024-25, which meets the Test One guarantee level, for state preschool, TK-12 public education, and community colleges.

Rebenches the guarantee to reflect the Proposition 28 arts funding and Universal Transitional Kindergarten growth in the Budget Year.

Reduces the projected Proposition 98 “Rainy Day” fund, the Public School System Stabilization Account, to $1.1 billion through the Budget year. Proposes a total of $8.4 billion in one-time withdrawals to support 2023-24 school expenditures, consistent with the enacted budget.

Defers $2.58 billion in 2022-23 funds that is paid using the Proposition 98 Rainy Day fund in 2023-24. Creates a one-time deferral of $4 billion in 2023-24 school and community college payments that is paid off in 2024-25.

Early Education and Child Care

Codifies the 2021-22 Budget Year agreement to grow the state-subsidized child care system by 200,000 new children served, and a new 2028 goal to reflect the May Revision “pause” proposal.

Fully funds all awarded expansion slots from existing child care appropriations and provides a general fund offset for new $48 million federal fund award not scored in May Revision, in addition to the May Revision offset proposals.

Creates a reversion accounting for all child care and general fund preschool programs.

Requires Department of Social Services reporting through January 2026 on the Alternative Methodology implementation progress, and requires a hold harmless policy in the Alternative Methodology to 2024-25 child care rates, inclusive of one-time cost of care plus payments.

Requires any Regional Market Rate used beginning in 2025-26 to eliminate the cap based on private payment rates.

Require annual reporting on proposed federal child care quality set-aside expenditure plan to be submitted to the Joint Legislative Budget Committee on or before May 14.

Sweeps $143 million General Fund and $206.3 million Prop 98 in one-time State Preschool savings, as proposed in the May Revision.

Eliminates the planned growth in the California State Preschool Program inclusive set-aside for the 2025-26 and 2026-27 fiscal years, capping the set-aside at 5%.

Expands California State Preschool Program eligibility to children ages 24 to 35 months.

Higher Education:

UC and CSU Base Increase in 2024-25. Provides a net base increase to each system in 2024-25 by funding the 2024-25 five percent base increases for the UC and CSU, foregoing the 2024-25 base increase deferral from the early action agreement, and adopting the May Revision proposal. Instead, the 2025-26 base increases are deferred by one year.

Key Institutes. Restores funding for the UC Labor Centers and the UCLA Latino Policy and Politics Institute.

Financial Aid.

Restores full funding for the Middle Class Scholarship program, which primarily benefits lower income students, rather than the May Revision proposal to dramatically reduce the program and force students into more student debt and hurt chances of thriving in the middle class upon graduation.

Implements a modified Cal Grant Reform which will benefit lower income students – particularly those at Community Colleges.

Provides $20 million Proposition 98 General Fund one-time to assist community college financial aid offices with unexpected workload and circumstances due to FAFSA delays and to help support students who are still trying to complete the FAFSA.

Climate and the Environment:

Greenhouse Gas Reduction Fund Shift. Protects over $5.2 billion in climate related investments by shifting the costs from the General Fund to the Greenhouse Gas Reduction Fund (GGRF).

Protects Key Investments. Rejects cuts to Dam Safety and Offshore Wind Infrastructure and partially rejects cuts to Sustainable Agriculture, Water Recycling, Extreme Heat, Equitable Building Decarbonization, Watershed Resilience, Ocean and Coastal Protection, and the Habitat Conservation Fund.

Health:

MCO Health Investments. Rejects the May Revision proposal to permanently eliminate over $2.4 billion in annual new health investments scheduled to take effect January 1, 2025. Instead, the new investments generally will be delayed one year until January 1, 2026, and there will be some modest Legislative adjustments to the new investments. Some added MCO rate enhancements will start in 2025 under the Legislature’s Budget Plan.

Public Health. Rejects the May Revision’s proposed cuts to Public Health programs.

Human Services:

Developmental Services Rates. Rejects the proposal to delay the Developmental Services rate increase by one year.

Child Care Slots. Restores funding for Child Care slots that have been recently offered, resulting in more than 11,000 funded slots than proposed in the May Revision.

Program Protections. Rejects cuts to core programs, including CalWORKs, Forster Care, and In Home Supportive Services (IHSS).

Tax and Fee Actions:

Approves the Governor’s proposal to suspend Net Operating Loss deductions and cap various business tax credits for three years. But, the Legislature’s Plan starts the three year period earlier than the Governor so that the suspension and cap will be in place for tax years 2024, 2025, and 2026. The Legislature’s Plan also includes several other tax and fee proposals advanced by the Governor, including changes to the MCO tax, changes to oil and gas-related taxation, changes to corporate tax apportionment law, and others. AB/SB 167 includes a statement of intent to pass future legislation to provide companies that forgo use of tax credits during the suspension with greater assurances they will be able to benefit from those credits later via a refundability option.

Housing and Homelessness:

HHAP. Provides $1 billion to HHAP Round 6 to provide local governments continued funding to combat the homelessness crisis.

Low Income Housing Tax Credits. Approves $500 million for Low Income Housing Tax Credit program, as proposed by the Governor.

Affordable Housing. Rejects proposed cuts to Multifamily Housing, Regional Early Action Planning (REAP) 2.0, and Housing Navigation and Maintenance Program.

Transportation:

Active Transportation. Rejects the proposed cut to the Active Transportation Program, and shifts to the State Highway Account.

Rail. Rejects the proposed cut to the Competitive Transit and Intercity Rail Capital Program.

Public Safety and Corrections:

Corrections Reductions. Includes substantial new reductions to the Department of Corrections and Rehabilitation, including a modified version of the Governor’s $80 million proposal to deactivate unused beds and a $170 million per year baseline cut in addition to the portion of the Governor’s statewide administrative cuts that will affect the Department of Corrections and Rehabilitation. The Legislature intends for the administration to avoid cuts, as much as possible, to vital rehabilitation and family connection programs, among others.

Victims of Crime Act Funding. Provides over $103 million ongoing to backfill lost federal funds for the Victims of Crime Act program.

Non-Profit Security. Provides $80 million ongoing for non-profit security grants.

Program Protections. Restores funding, in total in some cases, for key programs, including the Flexible Assistance for Survivors of Crime Grant program, the Public Defender Pilot Program, Adult Reentry Grant program, Court Reporters, Court Interpreters, and the Firearm Relinquishment program.

Labor:

Women in Construction. Rejects the proposal to eliminate the Women in Construction Unit at the Department of Industrial Relations (DIR).

Program Protections. Rejects cuts to California Youth Apprenticeship, California Youth Leadership Corps, and High Road Training Partnerships in Health and Human Services programs.

Workforce Education and Outreach. Provides $30 million in special funds for California Workplace Outreach Project (CWOP) at DIR.

Statewide Savings:

State Operations. The Legislature’s Plan accepts the Governor’s ambitious 7.95% cut to most departments’ General Fund state operations budgets and sweep of funding associated with many vacant positions, which collectively total about 10% of General Fund state operations and about $3 billion of 2024-25 savings. The Legislature expects to be kept informed of the administration’s progress throughout the year to achieve these savings and address impacts on public services that result.