FTB tax receipts in line with April forecast so far

Revenue forecasts likely to fall at May Revision by at least a few billion dollars

A later post on April 25 noted a weakened revenue outlook in the days after this post.

April FTB Collections Seem Broadly on Track. April tax collections and refunds at the Franchise Tax Board (FTB) are not yet complete, and data for other state tax collections (withholding and sales taxes, for example) do not emerge until later. The numbers so far, however, suggest that April income tax collections at FTB appear broadly in line with the administration’s monthly forecast (which was released in January). Net personal income tax (PIT) collections at FTB seem on track to be a few hundred million dollars above forecast, and net corporation tax (CT) collections seem poised to be a few hundred million dollars below forecast for the month.

May Revenue Estimates Likely to Fall…Maybe Not as Much as Feared. December and January tax receipts fell about $6 billion below the administration’s January forecast. In February (and then with an update in March), the Legislative Analyst’s Office (LAO) released a forecast update anticipating that General Fund revenues would fall short of the administration’s January forecast by $16 billion for the 2023-24 fiscal year and over $9 billion for 2024-25.

Since the LAO’s revenue downgrade, however, state personal income tax revenues—the state’s main revenue source—have outperformed the administration’s January forecasts. In February, General Fund revenues exceeded the administration’s forecast by $288 million with strength of PIT revenues offsetting weakness in sales and corporate taxes. In March, accordingly to the newly released Finance Bulletin, PIT revenues exceeded forecast by $683 million, more than offsetting a $247 million shortfall that month for corporate taxes. March sales taxes, however, were a disappointing $653 million below the monthly forecast. The December and January income tax shortfalls—as well as the recent sales tax weakness—mean that May Revision revenue estimates are very likely to fall, but, in my personal opinion, the performance of PIT revenues since then suggests the May revenue downgrade should not be as big as the LAO calculated.

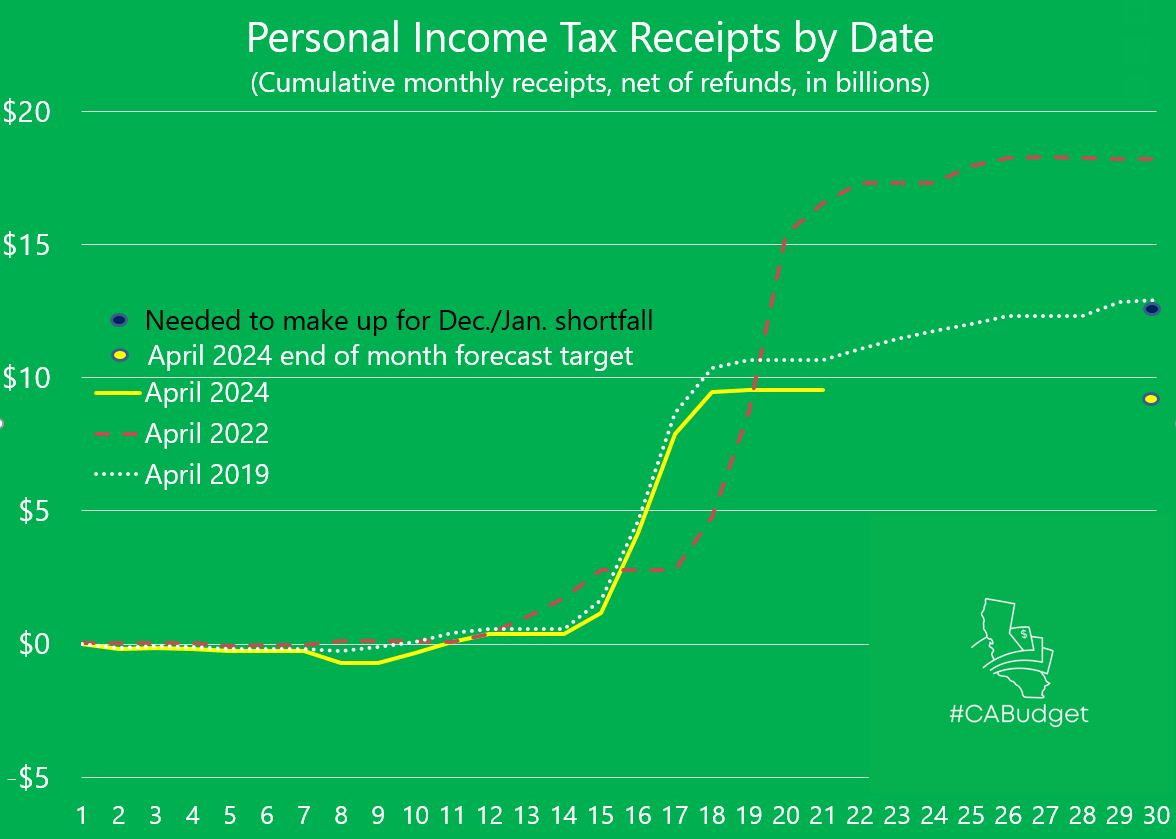

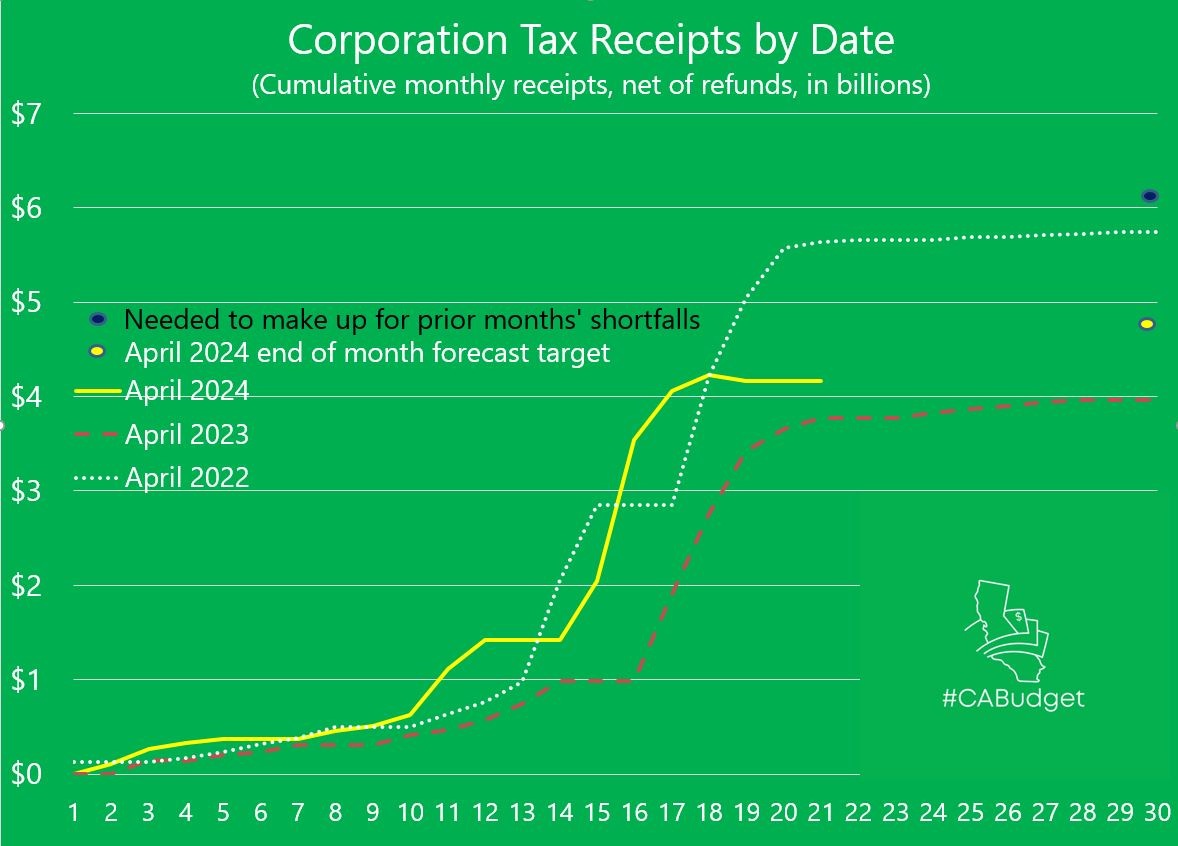

Daily Collections and Refunds Could Still Surprise This Month. Below are summary graphics showing FTB PIT and CT net collections to date this month, compared with a few prior years. The yellow dots on the right side indicate the end-of-month target in the administration’s January forecast for each tax, while the dark dots on the right side show where revenues would need to end up this month to make up for each tax’s shortfalls of prior months. As noted above, the trend to date suggests that FTB net PIT collections may end up a few hundred million above the monthly (yellow dot) estimate, while net CT collections may end up a few hundred million below the monthly estimate. A surprisingly large collection or refund day could still upset this trend, either positively or negatively.

Daily FTB collection updates will continue to be posted on my Threads and LinkedIn pages

Updated 12:30 pm, 4/22/2024 to reflect release of new Finance Bulletin with March sales tax data.