Departments' efficiency savings key in 2025 budget discussions

Recent questions have focused on universities' share of the reductions

Request questions to me have centered on planned budget cuts for the University of California (UC) and California State University (CSU), both of which were recently analyzed by the Legislative Analyst’s Office (LAO).

The 2024-25 state budget aimed to balance the state budget for a two-year period (2024-25 and 2025-26) with temporary corporate tax measures and withdrawal of about half the rainy day fund, among other actions. A key budget savings in the 2024-25 budget plan was an ongoing reduction in state operations costs of executive branch departments. The UC and CSU systems were included in those reductions. But, the inability of state departments and agencies in the Governor’s administration (“state departments”) to hit savings targets the administration proposed last May may leave the General Fund portions of these cuts predominantly focused on the universities for 2025-26 and beyond.

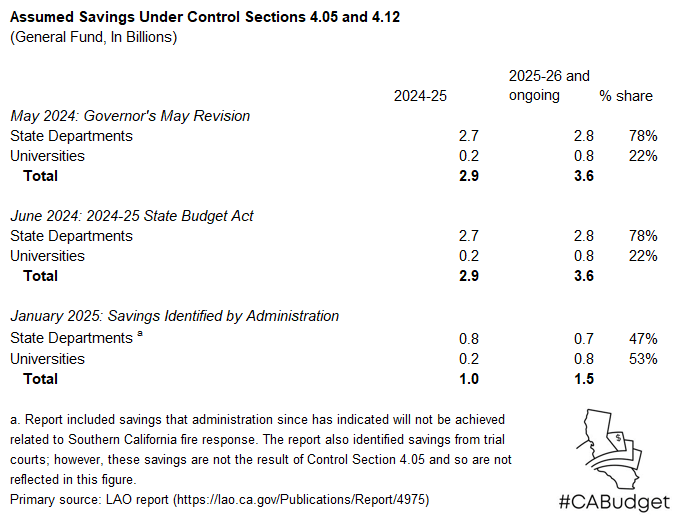

The 2024 budget gave the administration broad discretion to identify state departmental reductions in two “control sections” of the 2024-25 budget act: Section 4.05 (as amended in SB 108) and Section 4.12 (as amended in AB 107). In a February 19 report, LAO said a January 10 submission from the administration to the Joint Legislative Budget Committee showed identified savings for state departments well below the Governor’s proposals last year, but targeted savings for the universities remain similar. As a result, while the 2024 budget plan envisioned 78% of the ongoing portions of these General Fund savings coming from state departments and 22% from the universities, the January 10 administration report suggested this split might end up more like 47% from state departments and 53% from the universities. (Other sources may reflect somewhat different figures, as one can also consider non-General Fund savings from Sections 4.05 and 4.12, as well as trial court savings.)

The LAO indicated that an additional administration report on these administrative savings is expected, perhaps alongside the Governor’s May Revision. Identified savings levels could change. Moreover, the 2025-26 budget in June—to be passed by the Legislature and submitted to the Governor—could include different cut amounts.

“Unallocated” state department administrative cuts, like those in Sections 4.05 and 4.12 of the 2024 budget act, have been used in past budget downturns and have a long history of not meeting budgeted targets. As LAO noted in its report, the lower level of state department cuts identified by the administration last month were “significantly lower” than budgeted, but were a “perhaps more reasonable” level of efficiencies.

In a few cases, it is possible that new budget change proposals (BCPs) submitted by the administration this year request funding to backfill funds cut via Sections 4.05 and 4.12. For example, a BCP requesting funding to backfill previously used vacant position “salary savings” that is no longer available may in reality be backfilling state departments’ Section 4.05 or Section 4.12 savings. Review of such issues can occur only on a case by case basis during the budget process.

Given that the state is in a structural deficit position, with additional—perhaps massive—cuts expected from the federal government (including cuts in universities’ research funding), options to limit the planned General Fund cuts to universities from state resources are very limited. LAO, in its recent higher education analyses, has emphasized the need for the state to “signal more realistic budget expectations” to the universities for future years.

The LAO’s report on Sections 4.05 and 4.12 also discusses assumed savings in state departmental costs funded outside of the General Fund, such as state special funds. California’s state budgeting system includes more than 1,700 such accounts.

Recent LAO reports provide more information on these issues: