Tax Day in California and Next Week. As of today (November 16) at 7 p.m., Washington, D.C., time, the Internal Revenue Service appears to have left in place its oft-extended deadline of today (November 16) for most Californians to file 2022 tax returns, settle up 2022 income taxes, and pay their first three quarters of estimated 2023 taxes. It appears that the overwhelming majority of outstanding 2022 and 2023 tax payments—from those that have benefited the most from the nine-month tax deadline extension—are from some of the the very highest-income California tax filers and some large businesses. These filers often pay at the very last minute, and it takes payments several days to clear California’s Franchise Tax Board (FTB) systems. Accordingly, very large collection report days are possible next week.

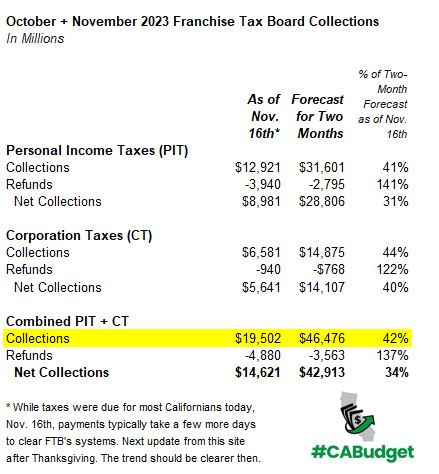

Significant Amount Still Needed to Hit Budget Projections. As of November 16, FTB income tax collections since Oct. 1 stand at about $19.5 billion—about $27 billion short of the amount projected to be received by Nov. 30. In recent disclosures to the state’s bond investors, the administration indicated it thought there was an “increasing likelihood” that this month’s collections will be short by a significant amount. Trends should be clearer after Thanksgiving. We shall see.

Next Update from Me: After Thanksgiving. I am out of the office on vacation next week and will not be logging in. (Remember that Tax Day was supposed to be one month ago!) Expect my next revenue update after Thanksgiving via Substack, Threads, Facebook, LinkedIn, and (for now at least) Bluesky.

Updates About Tax Deadlines. For authoritative updates about California tax filing and payment deadlines, always be sure to check official information sources, such as those of the IRS and FTB. IRS generally provides tax deadline information related to natural disaster declarations here.